AI as an Operating System: Building Predictable, Auditable Engineering Workflows

Published Jan 3, 2026

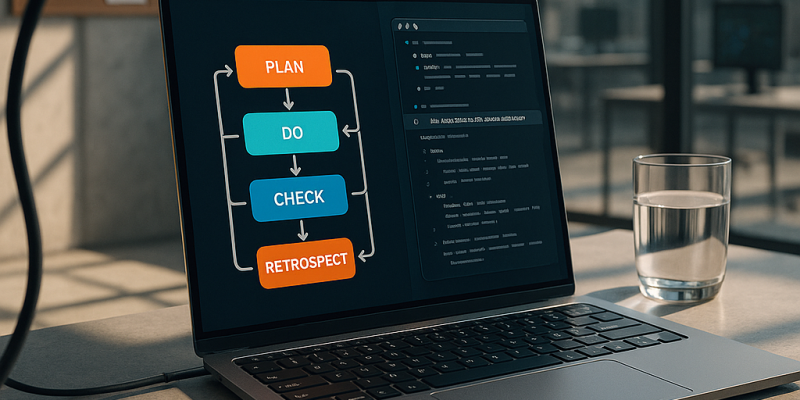

Over the last 14 days practitioners zeroed in on one problem: how to make AI a stable, auditable part of software and data workflows—and this note tells you what changed and what to watch. You’ll see a repeatable Plan–Do–Check–Verify–Retrospect (PDCVR) loop for LLM coding (examples using Claude Code and GLM‐4.7), multi‐level agents with folder‐level manifests plus a prompt‐rewriting meta‐agent, and control‐plane tools (DevScribe) that let docs execute DB queries, diagrams, and API tests. Practical wins: 1–2 day tickets dropped from ~8 hours to ~2–3 hours in one report (Reddit, 2026‐01‐02). Teams are also building data‐migration platforms, quantifying an “alignment tax,” and using AI todo‐routers to aggregate Slack/Jira/Sentry. Bottom line: models matter less than operating models, agent architectures, and tooling that make AI predictable, auditable, and ready for production.

Inside the AI-Native OS Engineers Use to Ship Software Faster

Published Jan 3, 2026

What if you could cut typical 1–2‐day engineering tasks from ~8 hours to ~2–3 while keeping quality and traceability? Over the last two weeks (Reddit posts 2026‐01‐02/03), experienced engineers have converged on practical patterns that form an AI‐native operating model you'll get here: the PDCVR loop (Plan–Do‐Check‐Verify‐Retrospect) enforcing test‐first plans and sub‐agents (Claude Code) for verification; folder‐level manifests plus a meta‐agent that rewrites prompts to respect architecture; DevScribe‐style executable workspaces that pair schemas, queries, diagrams and APIs; treating data backfills as idempotent platform workflows; coordination agents that quantify the “alignment tax”; and AI todo routers consolidating Slack/Jira/Sentry into prioritized work. Together these raise throughput, preserve traceability and safety for sensitive domains like fintech/biotech, and shift migrations and scope control from heroic one‐offs to platform responsibilities. Immediate moves: adopt PDCVR, add folder priors, build agent hierarchies, and pilot an executable workspace.

How AI Is Rewiring Software Engineering: PDCVR, Agents, Executable Workspaces

Published Jan 3, 2026

What if a typical 1–2 day engineering task drops from ~8 hours to ~2–3 hours? In the last two weeks practitioners (Reddit threads dated Jan 2–3, 2026) showed how: an AI‐native SDLC loop called PDCVR (Plan‐Do‐Check‐Verify‐Retrospect) built on Claude Code and GLM‐4.7, folder‐level priors plus a prompt‐rewriting meta‐agent, executable workspaces like DevScribe, repeatable data‐migration/backfill patterns, and tools to surface the “alignment tax.” PDCVR forces repo scans, TDD plans, small diffs, sub‐agents (open‐sourced in .claude on GitHub, Jan 3, 2026) to run builds/tests, and LLM retrospectives. Measured gains: common fixes go from ~8 hours to ~2–3 hours with 20‐minute prompts and short PR loops. Bottom line: teams in fintech, healthtech, trading and regulated sectors should adopt these operating models—PDCVR, multi‐level agents, executable docs, migration frameworks—and tie them to speed, quality, and risk metrics.

Inside the AI Operating Fabric Transforming Engineering: PDCVR, Agents, Workspaces

Published Jan 3, 2026

Losing time to scope creep and brittle AI output? In the past two weeks engineers documented concrete practices showing AI is becoming the operating fabric of engineering work: PDCVR (Plan–Do–Check–Verify–Retrospect) — documented 2026‐01‐03 for Claude Code and GLM‐4.7 with GitHub prompt templates — gives an AI‐native SDLC wrapper; multi‐agent hierarchies (folder‐level instructions plus a prompt‐rewriting meta‐agent) cut typical 1–2 day monorepo tasks from ~8 hours to ~2–3 hours (reported 2026‐01‐02); DevScribe (2026‐01‐03) offers executable docs (DB queries, diagrams, REST client, offline‐first); engineers pushed reusable data backfill/migration patterns (2026‐01‐02); posts flagged an “alignment tax” on throughput (2026‐01‐02/03); and founders prototyped AI todo routers aggregating Slack/Jira/Sentry (2026‐01‐02). Immediate takeaway: implement PDCVR‐style loops, agent hierarchies, executable workspaces and alignment‐aware infra — and measure impact.

AI as Engineer: From Autocomplete to Process-Aware Collaborator

Published Jan 3, 2026

Your team’s code is fast but fragile — in the last two weeks engineers, not vendors, published practical patterns to make LLMs safe and productive. On 2026‐01‐03 a senior engineer released PDCVR (Plan‐Do‐Check‐Verify‐Retrospect) using Claude Code and GLM‐4.7 with prompts and sub‐agents on GitHub; it embeds planning, TDD, build verification, and retrospectives as an AI‐native SDLC layer for risk‐sensitive systems. On 2026‐01‐02 others showed folder‐level repo manifests plus a prompt‐rewriting meta‐agent that cut routine 1–2‐day tasks from ~8 hours to ~2–3 hours. Tooling shifted too: DevScribe (site checked 2026‐01‐03) offers executable, offline docs with DBs, diagrams, and API testing. Engineers also pushed reusable data‐migration patterns, highlighted the “alignment tax,” and prototyped Slack/Jira/Sentry aggregators. Bottom line: treat AI as a process participant — build frameworks, guardrails, and observability now.

AI Is Becoming the Operating System for Software Teams

Published Jan 3, 2026

Drowning in misaligned work and slow delivery? In the last two weeks senior engineers sketched exactly what’s changing and why it matters: AI is becoming an operating system for software teams, and this summary tells you what to expect and do. Teams are shifting from ad‐hoc prompting to repeatable, auditable frameworks like Plan–Do–Check–Verify–Retrospect (PDCVR) (implemented on Claude Code + GLM‐4.7; prompts and sub‐agents open‐sourced, Reddit 2026‐01‐03), cutting error loops with TDD and build‐verification agents. Hierarchical agents plus folder manifests trim a task from ~8 hours to ~2–3 hours (20‐minute prompt, 2–3 feedback loops, ~1 hour testing). Tools like DevScribe collapse docs, queries, diagrams, and API tests into executable workspaces. Data backfills need platform controllers with checkpointing and rollforward/rollback. The biggest ops win: alignment‐aware dashboards and AI todo aggregators to expose scope creep and speed decisions. Immediate takeaway: harden workflows, add agent tiers, and invest in alignment tooling now.

How Teams Industrialize AI: Agentic Workflows, Executable Docs, and Coordination

Published Jan 3, 2026

Tired of wasted engineering hours and coordination chaos? Over the last two weeks (Reddit threads dated 2026‐01‐02 and 2026‐01‐03, plus GitHub and DevScribe docs), engineering communities shifted from debating models to industrializing AI‐assisted development — practical frameworks, agentic workflows, executable docs, and migration patterns. Key moves: a Plan–Do–Check–Verify‐Retrospect (PDCVR) process using Claude Code and GLM‐4.7 with prompts and sub‐agents on GitHub; multi‐level agents plus folder priors that cut a typical 1–2 day task from ~8 engineer hours to ~2–3 hours; DevScribe’s offline, executable docs for DBs and APIs; and calls to build reusable data‐migration and coordination‐aware tooling to lower the “alignment tax.” If you lead engineering, treat these patterns as operational playbooks now — adopt PDCVR, folder manifests, executable docs, and attention‐aggregators to secure measurable advantage over the next 12–24 months.

Inside PDCVR: How Agentic AI Boosts Engineering 3–4×

Published Jan 3, 2026

Tired of slow, error‐prone engineering cycles? Read on: posts from Jan 2–3, 2026 show senior engineers are codifying agentic coding into a Plan–Do–Check–Verify–Retrospect (PDCVR) workflow—Plan (repo inspection and explicit TDD), Do (tests first, small diffs), Check (compare plan vs. code), Verify (Claude Code sub‐agents run builds/tests), Retrospect (capture mistakes to seed the next plan)—with prompts and agent configs on GitHub. Multi‐level agents (folder‐level manifests plus a prompt‐rewriting meta‐agent) report 3–4× day‐to‐day gains: typical 1–2 day tasks dropped from ~8 hours to ~2–3 hours. DevScribe appears as an executable, local‐first workspace (DB integration, diagrams, API testing). Data migration, the “alignment tax,” and AI todo aggregators are flagged as platform priorities. Teams that internalize these workflows and tools will define the next phase of AI in engineering.

AI-Native SDLC: PDCVR, Agentic Workflows, and Executable Workspaces

Published Jan 3, 2026

Tired of AI “autocomplete” causing more rework? Reddit threads from 2026‐01‐02–03 show senior engineers wrapping LLMs into repeatable processes—here’s what matters for your org. They describe a Plan–Do–Check–Verify–Retrospect (PDCVR) loop (Claude Code + GLM‐4.7) that enforces TDD stages, separate build/verification agents, and prompt‐template retrospectives for auditability—recommended for fintech, biotech, and safety‐sensitive teams. Others report folder‐level manifests plus a prompt‐rewriting meta‐agent cutting 1–2‐day tasks from ~8 hours to ~2–3 hours (3–4× speedup). Tool trends: DevScribe’s “executable docs,” rising need for robust data‐migration/backfill frameworks, and coordination‐aware agent tooling to reduce weeks‐long alignment tax. Engineers now demand reproducible evals, exact prompts, and task‐level metrics; publish prompt libraries and benchmarks, and build verification and migration frameworks as immediate next steps.

PDCVR and Agentic Workflows Industrialize AI‐Assisted Software Engineering

Published Jan 3, 2026

If your team is losing a day to routine code changes, listen: Reddit posts from 2026‐01‐02/03 show practitioners cutting typical 1–2‐day tasks from ~8 hours to about 2–3 hours by combining a Plan–Do–Check–Verify–Retrospect (PDCVR) loop with multi‐level agents, and this summary tells you what they did and why it matters. PDCVR (reported 2026‐01‐03) runs in Claude Code with GLM‐4.7, forces RED→GREEN TDD in planning, keeps small diffs, uses build‐verification and role subagents (.claude/agents) and records lessons learned. Separate posts (2026‐01‐02) show folder‐level instructions and a prompt‐rewriting meta‐agent turning vague requests into high‐fidelity prompts, giving ~20 minutes to start, 10–15 minutes per PR loop, plus ~1 hour for testing. Tools like DevScribe make docs executable (DB queries, ERDs, API tests). Bottom line: teams are industrializing AI‐assisted engineering; your immediate next step is to instrument reproducible evals—PR time, defect rates, rollbacks—and correlate them with AI use.