Google Unveils Gemini 3.0 Pro: 1T-Parameter, Multimodal, 1M-Token Context

Published Nov 18, 2025

Worried your AI can’t handle whole codebases, videos, or complex multi-step reasoning? Here’s what to expect: Google announced Gemini 3.0 Pro / Deep Think, a >1 trillion-parameter Mixture-of-Experts model (about 15–20B experts active per query) with native text/image/audio/video inputs, two context tiers (200,000 and 1,000,000 tokens), and stronger agentic tool use. Benchmarks in the article show GPQA Diamond 91.9%, Humanity’s Last Exam 37.5% without tools and 45.8% with tools, and ScreenSpot-Pro 72.7%. Preview access opened to select enterprise users via API in Nov‐2025, with broader release expected Dec‐2025 and general availability early 2026. Why it matters: you can build longer, multimodal, reasoning-heavy apps, but plan for higher compute/latency, privacy risks from audio/video, and robustness testing. Immediate watch items: independent benchmark validation, tooling integration, pricing for 200k vs 1M tokens, and modality-specific safety controls.

WebAssembly at the Edge: Serverless Speed Without the Container Bloat

Published Nov 18, 2025

Struggling with slow serverless cold starts and bulky container images? Read on for a quick, actionable read: recent signals — led by the Lumos study (Oct 2025) — show WebAssembly (WASM)-powered, edge-native serverless architectures gaining traction, with concrete numbers, risks, and next steps. Lumos found AoT-compiled WASM images can be up to 30× smaller and reduce cold-start latency by ~16% versus containers, while interpreted WASM can suffer up to 55× higher warm-up latency and 10× I/O serialization overhead. Tooling like WASI and community benchmarks are maturing, and use cases include AI inference, IoT, edge functions, and low-latency UX. What to do now: engineers should evaluate AoT WASM for latency-sensitive components; DevOps must prepare toolchains, CI/CD, and observability; investors should watch runtime and edge providers. Flip to a macro trend needs major cloud/CDN SLAs, more real-world benchmarks and high-profile deployments; confidence today: ~65–75% within 6–12 months.

Helios and IBM Roadmaps Make Fault-Tolerant Quantum Imminent

Published Nov 18, 2025

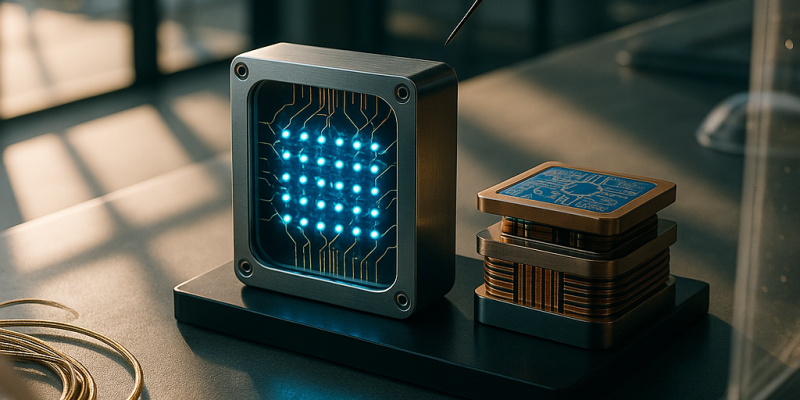

Think quantum advantage is still vaporware? This week’s hardware pushes say otherwise—and here’s what you need in 60 seconds: on 2025-11-06 Quantinuum launched Helios: 98 barium‐ion physical qubits delivering 48 error‐corrected logical qubits with single‐qubit fidelity 99.9975% and two‐qubit 99.921%, plus DARPA picked Quantinuum for Stage B of the Quantum Benchmarking Initiative to validate its Lumos-to‐2033 roadmap. On 2025-11-12 IBM unveiled Loon (a pathfinder for error‐correction architectures) and announced Nighthawk for end‐2025, which it says could beat classical machines on select tasks by late 2026 and aims for useful systems by 2029. Why it matters: error correction is moving from theory into hardware, changing timelines for customers, investors, and security. Watch Helios’ real workloads, DARPA’s evaluation, Nighthawk benchmarks and Loon’s architecture next.

Beyond GLP‐1: Dual/Triple Agonists Set to Transform Obesity Treatment

Published Nov 18, 2025

If you think GLP‐1s are the endgame, think again: on 2025‐11‐06 Novo Nordisk reported CagriSema cut systolic blood pressure by 10.9 mmHg and hs‐CRP by 68.9% over 68 weeks — outperforming semaglutide and placebo — and regulators may see filings in early 2026. You’ll get broader benefits: Redefine‐5 showed 18.4% mean weight loss for CagriSema versus 11.9% for semaglutide, and orforglipron (oral) delivered ~11% weight loss at 72 weeks. Startups (e.g., Syntis Bio) promise surgery‐mimetic capsules with human data due 2026. Why care? These multi‐agonists and new modalities shift value from pure weight loss to cardiovascular, inflammatory and patient‐experience endpoints, altering payer economics, trial design, manufacturing and go‐to‐market plans. Next inflection points: CagriSema regulatory milestones in Q1 2026 and upcoming Phase‐3/long‐term safety data that will set commercialization and pricing dynamics.

Retrieval Is the New AI Foundation: Hybrid RAG and Trove Lead

Published Nov 18, 2025

Worried about sending sensitive documents to the cloud? Two research releases show you can get competitive accuracy while keeping data local. On Nov 3, 2025 Trove shipped as an open-source retrieval toolkit that cuts memory use 2.6× and adds live filtering, dataset transforms, hard-negative mining, and multi-node runs. On Nov 13, 2025 a local hybrid RAG system combined semantic embeddings and keyword search to answer legal, scientific, and conversational queries entirely on device. Why it matters: privacy, latency, and cost trade-offs now favor hybrid and on‐device retrieval for regulated customers and production deployments. Immediate moves: integrate hybrid retrieval early, vet vector DBs for privacy/latency/hybrid support, use Trove-style evaluation and hard negatives, and build internal pipelines for domain tests. Outlook: ~80% confidence RAG becomes central to AI stacks in the next 12 months.

Rust, Go, Swift Become Non-Negotiable After NSA/CISA Guidance

Published Nov 18, 2025

One memory bug can cost you customers, downtime, or trigger regulation — and the U.S. government just escalated the issue: on 2025-11-16 the NSA and CISA issued guidance calling memory-safe languages (Rust, Go, Swift, Java, etc.) essential. Read this and you’ll get what happened, why it matters, key numbers, and immediate moves. Memory-safety flaws remain the “most common” root cause of major incidents; Google’s shift to Rust cut new-code memory vulnerabilities from ~76% in 2019 to ~24% by 2024. That convergence of federal guidance and enterprise pressure affects security posture, compliance, insurance, and product reliability. Immediate steps: assess exposed code (network-facing, kernel, drivers), make new modules memory-safe by default, invest in tooling (linting, fuzzing), upskill teams, and track migration metrics. Expect memory-safe languages to become a baseline in critical domains within 1–2 years (≈80% confidence).

Why Enterprises Are Racing to Govern AI Agents Now

Published Nov 18, 2025

By 2028 Microsoft projects more than 1.3 billion AI agents will be operational—so unmanaged agents are fast becoming a business risk. Here's what you need to know: on Nov. 18, 2025 Microsoft launched Agent 365 to give IT appliance‐like oversight (authorize, quarantine, secure) and Work IQ to build agents using Microsoft 365 data and Copilot; the same day Google released Gemini 3.0, a multimodal model handling text, image, audio and video. These moves matter because firms face governance gaps, identity sprawl, and larger attack surfaces as agents proliferate. Immediate implications: treat agents as first‐class identities (Entra Agent ID), require audit logs, RBAC, lifecycle tooling, and test multimodal risks. Watch Agent 365 availability, Entra adoption, and Gemini 3.0 enterprise case studies—and act now to bake in identity, telemetry, and least privilege.

Edge AI Revolution: 10-bit Chips, TFLite FIQ, Wasm Runtimes

Published Nov 16, 2025

Worried your mobile AI is slow, costly, or leaking data? Recent product and hardware moves show a fast shift to on-device models—and here’s what you need. On 2025-11-10 TensorFlow Lite added Full Integer Quantization for masked language models, trimming model size ~75% and cutting latency 2–4× on mobile CPUs. Apple chips (reported 2025-11-08) now support 10‐bit weights for better mixed-precision accuracy. Wasm advances (wasmCloud’s 2025-11-05 wash-runtime and AoT Wasm results) deliver binaries up to 30× smaller and cold-starts ~16% faster. That means lower cloud costs, better privacy, and faster UX for AR, voice, and vision apps, but you must manage accuracy, hardware variability, and tooling gaps. Immediate moves: invest in quantization-aware pipelines, maintain compressed/full fallbacks, test on target hardware, and watch public quant benchmarks and new accelerator announcements; adoption looks likely (estimated 75–85% confidence).

Quantum Error Correction Advances Push Fault-Tolerant Computing Toward Reality

Published Nov 16, 2025

Between 2025-11-02 and 2025-11-12 the quantum computing field reported multiple QEC advances: DARPA selected QuEra and IBM for Stage B of its Quantum Benchmarking Initiative on 2025-11-06, awarding up to US$15 million over 12 months each to validate paths toward fault-tolerant systems with QBI targeting “computational value exceeds cost” by 2033; Princeton on 2025-11-05 demonstrated a tantalum-on-silicon superconducting qubit with coherence >1 ms (≈3× prior lab best, ≈15× industry standard); ECCentric published on 2025-11-02 benchmarking code families and finding connectivity more important than code distance; BTQ/Macquarie published an LDPC/shared-cavity QEC method; IBM revealed its Loon chip on 2025-11-12 and expects Nighthawk by end-2025 with possible task-level quantum advantage by late-2026. These developments lower error-correction overhead, emphasize hardware–code co-design, and point to near-term validation steps: QBI Stage C, public Loon/Nighthawk metrics, and verification of logical-qubit lifetimes.

In Vivo Gene Editing Emerges as Biotech’s Next Frontier

Published Nov 16, 2025

In the last ~14 days the in vivo gene‐editing field accelerated: Azalea Therapeutics (co‐founded by Jennifer Doudna) raised US$82M Series A led by Third Rock to advance a single‐dose dual‐vector permanent genome‐editing approach targeting an in vivo CAR‐T for B‐cell malignancies, aiming for the clinic in 12–18 months; Stylus Medicine secured $85M from investors including J&J and Eli Lilly to build next‐generation in vivo genetic medicines; and Vertex ended its Verve collaboration, reclaiming a liver program while deprioritizing certain delivery platforms. These developments shift investor appetite toward clinically directed, scalable delivery solutions, raise regulatory and safety scrutiny around vectors and durability, and create near‐term catalysts to watch: IND submissions/first dosing, preclinical safety data on novel delivery vectors, and regulatory guideline updates.